How to effectively calculate your Stamp Duty bill

When you’re buying a property, Stamp Duty is an essential bill you need to include in your budget. Depending on the property you purchase and your circumstances, it could add thousands of pounds to the cost. Read on to find out what you need to know about Stamp Duty.

Stamp Duty receipts increased by 4% in 2022/23 when compared to a year earlier

According to HMRC, Stamp Duty receipts increased by 4% between 2021/22 and 2022/23. In fact, during the 2022/23 tax year, property buyers paid £19,130 million in Stamp Duty.

There are several reasons for the rise in Stamp Duty receipts, including increasing property prices.

In 2022/23, the number of properties valued at £250,000 or less accounted for 48% of all transactions – a fall of 4% when compared to a year earlier. Conversely, the number of properties valued at more than £1 million accounts for 4% after increasing by 1%.

If you’re buying property for more than £250,000, you’ll need to pay Stamp Duty. Here’s how to calculate your bill.

Your Stamp Duty bill will depend on the value of the property you buy

Stamp Duty is a type of tax you pay when you buy residential property or a piece of land in England and Northern Ireland.

There are several rate bands for Stamp Duty and the tax is calculated on the part of the property purchase price that falls within each band. In 2023/24, the Stamp Duty rates are:

So, if you’re purchasing a £1 million property that will be your main home and you don’t benefit from any relief, your Stamp Duty bill would be £41,250 in 2023/24. This would be calculated based on:

- The portion up to £250,000 with a Stamp Duty rate of 0%: £0

- The portion between £250,000 and £925,000 with a Stamp Duty rate of 5%: £33,750

- The portion between £925,001 and £1 million with a Stamp Duty rate of 10%: £7,500.

You can use the government’s Stamp Duty calculator to understand how your circumstances could affect your Stamp Duty bill.

Please note, that if you’re buying property in Scotland or Wales, instead of Stamp Duty, you’ll need to pay Land and Buildings Transaction Tax in the former or Land Transaction Tax in the latter. In both Scotland and Wales, the tax rates and reliefs for buying property are different than in England.

First-time buyers could benefit from Stamp Duty relief

If you’re a first-time buyer, a Stamp Duty relief could mean you benefit from a lower bill or that you avoid needing to pay the charge.

As a first-time buyer, you may not need to pay Stamp Duty if the value of the property is below £425,000. You might also pay a lower rate of 5% on the portion between £425,001 and £625,000. So, this relief could save you thousands of pounds.

However, if the value of the property is more than £625,000, you cannot claim the relief.

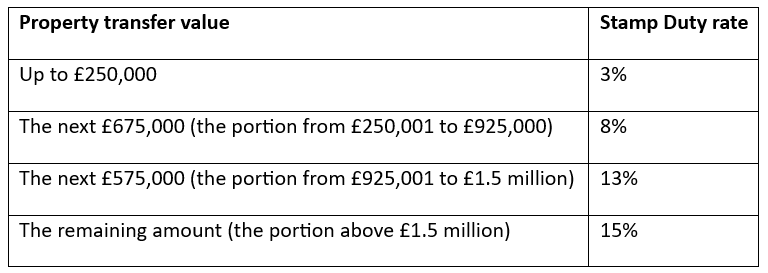

You usually pay a 3% surcharge if you own another property

If you already own another property that you will not be selling, you will usually need to pay an additional 3% Stamp Duty.

So, if you’re buying a holiday home or buy-to-let property, you should be prepared for a potentially higher bill. The rates for second properties in 2023/24 are:

Contact us if you’ll be taking out a mortgage to buy a property

Whether you’re a first-time buyer or a buy-to-let investor, if you’ll be using a mortgage to buy your property, we could help you secure one. We can offer you guidance when applying for a mortgage and navigating the homebuying process.

Please contact us to arrange a meeting to discuss your mortgage needs.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Contact us

For a no-obligation consultation, just leave us a message and we’ll be in touch to arrange a chat.